Credbull’s Licensed On-chain Private Credit Fund 1

Credbull's Licensed On-chain Private Credit Fund represents a groundbreaking advancement in decentralized finance (DeFi), providing unparalleled transparency and accessibility to investors by bringing the entire fund on-chain. Unlike traditional Real World Asset (RWA) investment opportunities that often lack transparency and remain off-chain, Credbull's approach offers real-time visibility into its strategy, risk management, and performance. By issuing 'Claim Tokens' for self-custody, Credbull empowers decentralized governance, establishing new standards for transparency and accountability in the industry.

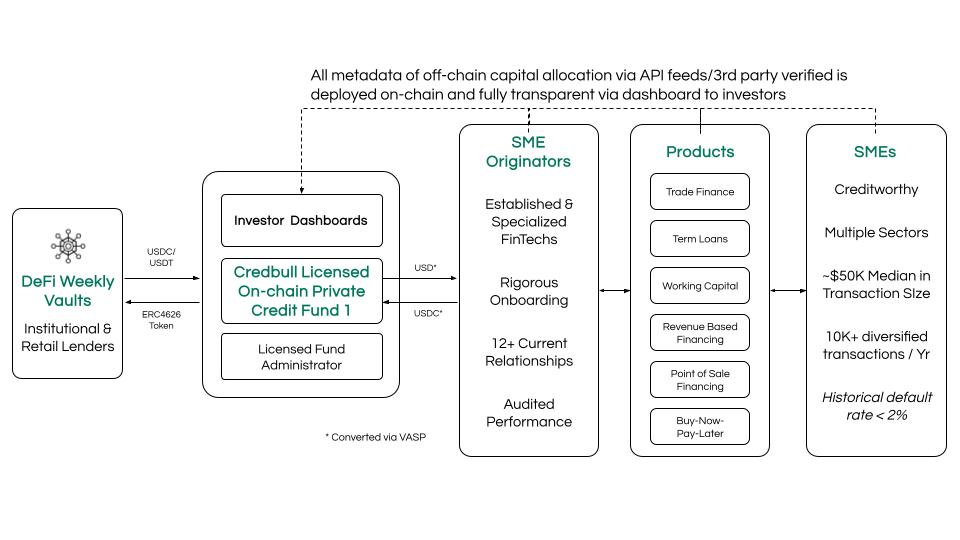

Fig 2: Fund flow from lenders to transparent deployment of capital to SME Originators, by Product, by SME Transactions

Highlights of the Credbull On-Chain Private Credit Fund 1

- Private Credit Access: A pivotal aspect of Credbull’s On-chain Private Credit Fund is offering investors the opportunity to tap into high-performing assets traditionally inaccessible to retail investors. Through established SME Originators, the fund provides access to private credit opportunities backed by tangible assets in sectors such as energy, agriculture, and infrastructure. This direct exposure to real-world assets not only diversifies investors' portfolios but also ensures a balanced capital preservation strategy. By bridging the gap between traditional finance and decentralized finance, Credbull empowers investors to participate in the growth of real-world businesses while benefiting from the transparency and accessibility of blockchain technology, thereby democratizing access to lucrative investment opportunities within the decentralized finance landscape.

- Transparency Across the Investment Life Cycle: Credbull ensures transparency throughout the investment process, from strategy formulation to risk management and performance evaluation, as well as capital allocation by Originator, product, and all SME transactions. By placing the entire fund on-chain and providing 'Claim Tokens' for self-custody, investors have real-time visibility into the fund's operations, enhancing trust and confidence.

- Innovative Solution Addressing Market Challenges: Credbull's approach directly tackles critical challenges plaguing the market, including crypto volatility, suboptimal monetization of crypto platforms, and opacity in traditional asset management. By providing transparent and accessible investment opportunities, Credbull reshapes the landscape of both traditional finance (TradFi) and decentralized finance (DeFi).

- High Fixed Yields: A hallmark of Credbull’s On-chain Private Credit Fund is providing investors with stable returns in volatile markets. By structuring yields to offer predictability and consistency, the fund appeals to investors seeking reliable yield. This stability is achieved through targeted asset allocation and robust risk management strategies, ensuring that investors can count on steady yield regardless of market fluctuations. In today's low-interest-rate environment, Credbull's high fixed yields offer an attractive opportunity for income generation and portfolio diversification, underscoring the fund's commitment to delivering value and stability to investors within the decentralized finance landscape.

- Flexible Lock-ups: A distinguishing feature of Credbull’s On-chain Private Credit Fund is offering investors the freedom to tailor their investment timelines to align with their individual goals and preferences. This flexibility allows investors to choose lock-up periods that best suit their liquidity needs, whether they prefer short-term commitments or are willing to lock in their funds for longer durations. By accommodating varying investment horizons, Credbull enhances investor satisfaction and customization, empowering them to make informed decisions that align with their financial objectives. This feature not only enhances the fund's appeal to a broader range of investors but also contributes to its overall accessibility and inclusivity within the decentralized finance ecosystem.

Updated 3 months ago