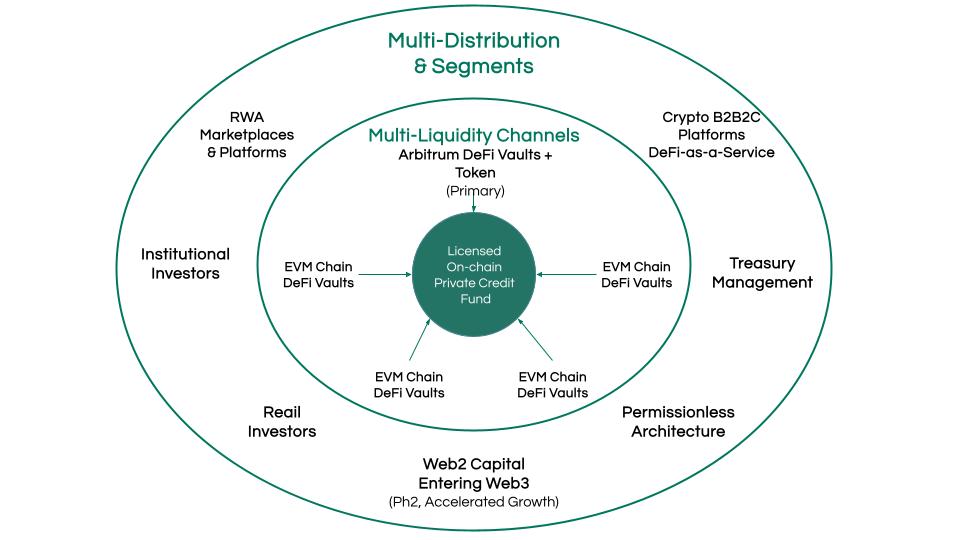

Orbit TVL Distribution & Go-to-Market

The Orbit Distribution Strategy is designed for go-to-market with high scalability, operating across multiple liquidity pools and segments. Its execution occurs in phases, with a prioritisation ratio of 80/20 Pareto principle to ensure focused efforts. The Pareto principle states that for many outcomes, roughly 80% of the consequences come from 20% of the causes (the “vital few”) - in this case, we focus on 20% of the client platforms/segments to unlock 80% of the liquidity/Total Value Locked (TVL).

Fig 4: Credbull’s Orbit distribution and Go-to-Market strategy

Credbull's Licensed On-Chain Private Credit Fund operates on Polygon, migrating to Plume Network in Q4, leveraging Centrifuge’s on-chain asset management infrastructure. while its DeFi lending vaults remain chain-agnostic, accessing diverse liquidity sources. Initially deployed on Arbitrum, the vault gradually expands to accommodate liquidity across different destinations over time.

Distribution channels and segments leverage Credbull structured high fixed yield products on preferred EVM chains, with a primary focus on RWA Marketplaces and B2B2C Platforms. Examples of B2B2C Platforms include crypto custodians, liquidity providers, DApps, CEX/DEX, stablecoin lending platforms, crypto wallet platforms etc.

Additional liquidity sources include project treasuries, institutional investors, and crypto natives seeking diversified, high fixed yields.

In phase 2, Credbull’s open architecture vaults democratizes access to private credit globally. 3rd party Web3 projects can deploy their own Credbull vaults in a permissionless manner

- Build offering by regional target, e.g. Brazil, LatAm, Africa

- Access to same products and terms - TVL to Credbull

- Receive distribution fee, incentives and customizable features

- Expand GTM distribution globally

A compelling long-term prospect awaits in drawing new Web 2 capital into Web 3. Within the crypto market, liquidity appears akin to a red pond[^1], constantly shifting between crypto protocols and projects driven by ever-changing narratives. Yet, there's been a noticeable absence of net new capital inflow since the last cycle. Our strategic vision involves enticing fresh Web 2 capital into the realms of Web 3 through our DeFi fund. Presently, Web 2 lacks offerings of uncorrelated, high fixed yields with low minimum investment thresholds, presenting vast potential for adeptly executed go-to-market strategies.

The Orbit strategy spans multiple distribution channels and segments, driving widespread impact and fostering sustained growth.

Updated 3 months ago